- Sustainability

- Governance

-

Corporate Governance

Corporate Governance

-

Basic Policy on Corporate Governance

-

Outline of the Corporate Governance System

-

Board of Directors

-

Audit & Supervisory Board

-

Committee on Personnel and Remuneration, etc.

-

Key Experience, Knowledge and Expertise of Directors and Audit & Supervisory Board Members

-

Executive Committee and Other Meetings Relating to Business Operation and Management

-

Corporate Governance Committee

-

Internal Auditing

-

Policy on Directors' and Audit & Supervisory Board Members' Remuneration

-

Dialogue with Shareholders

Basic Policy on Corporate Governance

Through fair and efficient corporate activities, Suzuki aims to earn the trust of our shareholders, customers, suppliers, local communities, employees, and other stakeholders, and to make further contributions to the international community in order to continue to grow and develop as a sustainable company. To achieve this goal, we recognize that continuous enhancement of corporate governance is essential, and as a top priority management issue, we are actively working on various measures.

In consideration of the meaning of the respective principles of the Corporate Governance Code as established by the Tokyo Stock Exchange, Suzuki will make continuous efforts to ensure the rights and equality of shareholders and the effectiveness of the Board of Directors and the Audit & Supervisory Board, as well as to upgrade the internal control system.

Also, in order to be trusted further by society and stakeholders, we will disclose information immediately in a fair and accurate manner prescribed by laws and regulations, and actively disclose information that we consider is beneficial to deepen their understanding of the Company, so as to further enhance the transparency of the Company.

Corporate Governance Report

https://www.globalsuzuki.com/ir/library/governance/pdf/report.pdf

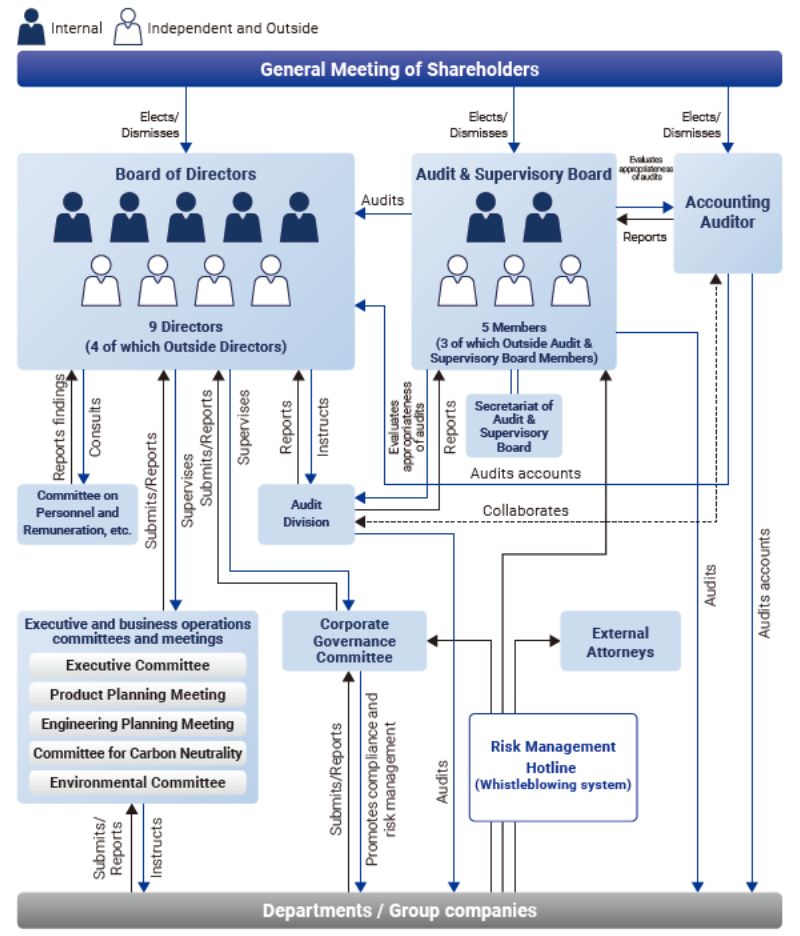

Outline of the Corporate Governance System

Suzuki is a company with an audit and supervisory board. The Audit & Supervisory Board consists of two full-time Audit & Supervisory Board Members who are familiar with internal circumstances and have advanced information gathering capabilities, alongside three Outside Audit & Supervisory Board Members with a strong degree of independence and a high level of expertise and knowledge. Every Audit & Supervisory Board Member—who can each exercise auditing authority through the Audit & Supervisory Board and independently under the single auditor system—plays a part of corporate governance.

In addition, we have established a committee to deliberate on the appropriateness of the nomination of and remuneration for Directors, alongside efforts to strengthen the corporate governance system through other initiatives.

■Corporate Governance Framework

■Corporate Governance Initiatives

(FY)

| Until 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | From 2025 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mid-Term Management Plan | Mid-term management targets |

Mid-Term Management Plan “SUZUKI NEXT 100” |

Mid-Term Management Plan “Sho-Sho-Kei-Tan-Bi (Smaller, Fewer, Lighter, Shorter, Beauty)” |

Mid-Term Management Plan “By Your Side” |

|||||||||||||||||||||||

| Directors | |||||||||||||||||||||||||||

| Term | Term for Directors since 2002: 1 year | ||||||||||||||||||||||||||

| Supervision/ execution |

Introduced a managing officer system in 2006 (number of Directors decreased from 29 to 14) | ||||||||||||||||||||||||||

| Number of members | Since June 2013: 9 | 8 | 9 | 8 | 9 | ||||||||||||||||||||||

| Number of Outside Directors |

Since June 2012: 2 | 3 | 4 | ||||||||||||||||||||||||

| Number of female Directors |

1 | 2 | |||||||||||||||||||||||||

| Audit & Supervisory Board Members | |||||||||||||||||||||||||||

| Number of members | Since 2001: 5 | ||||||||||||||||||||||||||

| Number of outside members |

Since 2001: 3 | ||||||||||||||||||||||||||

Board of Directors

The Company adopted a Managing Officer system in 2006 with the aim of speeding up decision-making at the Board of Directors, executing business flexibly and clarifying accountability, and has made progress in slimming the composition of the Board of Directors. There are currently nine Directors, of which four are Outside Directors who are elected to strengthen the Board's function of supervising business management, as well as provide useful advice, suggestions, etc. on the Company's business management, based on their respective experience, knowledge, and diverse perspectives.

In principle, the Board of Directors meets once a month and also as needed. It works to strengthen supervision by making decisions on basic management policies, important business execution matters, matters authorized by the General Meeting of Shareholders to the Board of Directors, and other matters stipulated by laws and regulations and the Articles of Incorporation based on sufficient discussion, including from the perspective of legal compliance and corporate ethics, as well as receiving reports on the execution of important business operations as appropriate.

In order to clarify managerial accountability for individual Directors and flexibly respond to the changing business environment, the term of each Director is set at one year.

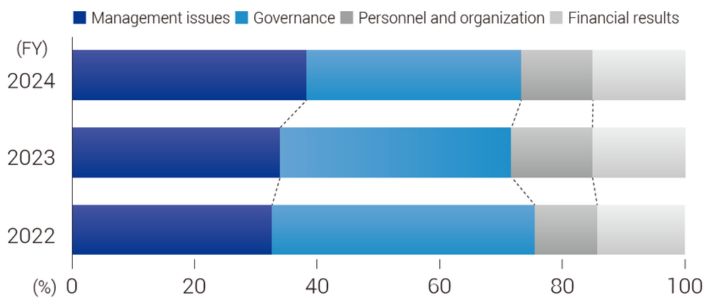

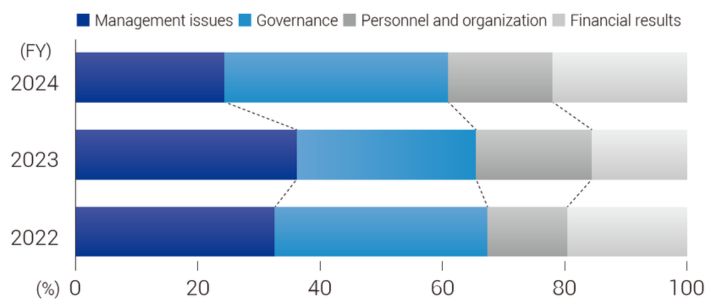

■Composition of Matters to be Resolved and Matters to Be Discussed at Board of Directors Meetings

■Composition of Matters Reported in Board of Directors Meetings

- Note:

- There has been an increase in the number of matters to be discussed for various strategies aimed at formulating the Mid-Term Management Plan with Outside Directors.

■Agenda Items at Board of Directors Meetings (Examples)

| Matters resolved/discussed | Matters reported | |

|---|---|---|

| Management issues |

|

|

| Corporate governance, internal control |

|

|

Evaluation of the effectiveness of the Board of Directors

The Company conducts an annual analysis and evaluation to improve the effectiveness of the Board of Directors. An outline of the FY2024 analysis and evaluation is as follows.

Method of analysis and evaluation (conducted February–June 2025)

In February 2025, we announced the Mid-Term Management Plan “By Your Side”, which embodies our growth strategy for FY2030.

The Board of Directors conducted analysis and evaluation to further enhance its effectiveness, including identifying agenda items to deliberate on, such as those necessary for the Board to accurately supervise the progress of the Mid-Term Management Plan, and other matters requiring deliberation by the Board, as well as measures to enhance deliberations and a review of initiatives undertaken in FY2023.

- Board of Directors secretariat interviews with all Directors and Audit & Supervisory Board Members

- Future initiatives discussed by the execution side mainly based on the opinions of Outside Directors and Outside Audit & Supervisory Board Members

- Future initiatives deliberated on and confirmed by the Board of Directors

Outline of results

The Company believes that receiving valuable insights and opinions from Outside Directors and Outside Audit & Supervisory Board Members is essential to the effectiveness of its Board of Directors, and actively provides them with information and opportunities to deepen their understanding of the Company's management and operations, such as voluntary attendance at meetings other than Board of Directors meetings, provision of materials and minutes, factory inspections and exchanges of views with Directors of Maruti Suzuki India Limited (a Suzuki subsidiary in India, one of the Suzuki Group's main markets).

In evaluating the effectiveness of the Board of Directors, we identified issues mainly based on the findings of Outside Directors and Outside Audit & Supervisory Board Members, and determined initiatives for FY2025 accordingly. We will continue to strive to further improve the effectiveness of the Board of Directors.

Examples of issues

- 1) Setting annual agenda items based on the findings of Outside Directors and Outside Audit & Supervisory Board Members

- 2) Providing information that can be used as a source of discussion and judgment, such as external conditions and trends

- 3) Appropriate reporting of progress regarding the Board of Directors' findings

- 4) Organizing agenda items to be submitted to the Board of Directors from the executive and business operations committees, etc.

[Ref.] Issues from the FY2023 (Previous) Analysis and Evaluation, and Results of Initiatives in FY2024

Examples of issues

- 1) Enhancing deliberations on various strategies for formulating the mid-term management Plan

- 2) Agenda management from submission to executive and business operations committees, etc. to submission to the Board of Directors

- 3) Feedback on the status of responses to findings raised at Board of Directors meetings

Results of initiatives

(Opinions of Outside Directors and Outside Audit & Supervisory Board Members in the FY2024 evaluation and analysis)

- The agenda is more focused on matters related to growth strategy and organizational reform.

- Greater emphasis placed on free discussion with Outside Directors and Outside Audit & Supervisory Board Members due to the chair's efforts.

- Being able to participate in other meetings aside from Board of Directors meetings has given members a more multifaceted understanding of the issues facing Suzuki and the current progress of the Board of Directors, as well as smooth understanding of discussions at Board of Directors meetings.

Ongoing issues

(Opinions of Outside Directors and Outside Audit & Supervisory Board Members in the FY2024 evaluation and analysis)

Improved feedback on progress and results of measures discussed at Board of Directors meetings, progress reports on findings, etc.

Audit & Supervisory Board

The Audit & Supervisory Board aims to establish a high-quality corporate governance system in collaboration with the Board of Directors; one that responds to public trust and ensures sound and sustained growth for the Company and its Group companies, and creates medium- to long-term corporate value. As a stand-alone body, it conducts audits to ensure proper management and offers appropriate opinions to the management team.

Structure and procedures of the Audit & Supervisory Board

The Audit & Supervisory Board consists of five members: two full-time Audit & Supervisory Board Members with business experience, and three Outside Audit & Supervisory Board Members with advanced expertise and extensive experience in areas such as finance, accounting, technology, and legal affairs. Their audits are conducted from a variety of perspectives.

The audit procedures of Audit & Supervisory Board Members conform to the auditing standards established by the Audit & Supervisory Board and are conducted according to the auditing policy and division of duties. Audit & Supervisory Board Members audit the proper execution of corporate management and communicate their opinions by attending important meetings such as Board of Directors meetings, inspecting important approval documents, etc., and receiving reports and answers to inquiries from Directors and employees on the status of operations.

Activities of the Audit & Supervisory Board

In principle, the Company holds Audit & Supervisory Board meetings once a month, and otherwise as needed.

Audit & Supervisory Board Members also exchange opinions among themselves regarding agenda items before Board of Directors meetings are held, in an effort to ensure they can offer meaningful opinions in their role as Audit & Supervisory Board Members.

(1) Priority audit items for FY2024 included verifying the establishment and operation of an internal control system, focusing on schedule management for the development of new vehicle models, and improving the management and supervisory systems for outsourced development of automotive technology.

(2) A meeting to exchange opinions was held with Representative Directors, Outside Directors, officers and general managers to discuss a wide range of topics, including management challenges and risk awareness. At the same time, opinions were exchanged with the management of subsidiaries to confirm the operational status of Group governance systems.

■Examples of Audit & Supervisory Board Agenda Items

| Resolutions |

|

|---|---|

| Matters discussed |

|

| Matters reported |

|

Evaluation of the Effectiveness of the Audit & Supervisory Board

The Audit & Supervisory Board evaluates its effectiveness by having each member review its activities, conducting evaluations via a checklist, and providing opinions and suggestions by means of surveys. These are discussed and examined collectively by all members, and the findings are reflected in the next audit plan as action items in an effort to continually improve effectiveness.

Auditing Firm Selection Policy and Reason for Selection

Based on the determination policy for dismissal or non-reappointment of accounting auditors and using its own established assessment criteria, the Audit & Supervisory Board evaluated Seimei Audit Corporation for FY2024, examining its quality control, the independence and expertise of its audit teams, the level and content of audit fees, communication with Audit & Supervisory Board Members and management, the Group audit framework, and its response to fraud risks. As a result, it was determined that Seimei Audit Corporation is capable of performing appropriate audits. In addition to expectations that audits will be conducted from a new perspective, in order to further improve the SuzukiGroup's accounting governance, PwC Japan LLC was selected as the accounting auditor for FY2025 after comprehensive consideration of the quality management system, audit system including global responses, auditing methods, and independence.

Periodic Rotation and Reengagement of Accounting Auditors

Operations are carried out as follows in accordance with the regulations of the auditing firm based on the Certified Public Accountants Act, etc.:

- 1. Engagement partners may not be involved in the Company's audit work for more than seven accounting periods, and the lead engagement partner may not be involved in the audit work for more than five accounting periods.

- 2. Engagement partners may not be involved in the Company's audit work for two accounting periods after the change, and the lead engagement partner may not be involved in the audit work for five accounting periods after the change.

Evaluation of audit firm by the Audit & Supervisory Board and its members

The Audit & Supervisory Board obtains the necessary materials from the relevant internal departments (finance and internal audit departments) and the accounting auditors, receives reports, and evaluates the audit firm against its established evaluation criteria.

Training of Directors and Audit & Supervisory Board Members

The Company provides training sessions to help Directors and Audit & Supervisory Board Members deepen their understanding of their roles and responsibilities. In principle, the training is intended to be taken together by Directors and Audit & Supervisory Board Members as an opportunity to share information on their respective roles, responsibilities, etc.

Furthermore, the Company conducts training to enhance the skills of its officers, such as theater workshops where officers act out the conduct, roles, and responsibilities expected of officers and the conduct they should adopt while setting aside their egos; and training on topics such as compliance, risk management, the Company's history, feedback from shareholders and investors, capital policy, shareholder returns, digital transformation, AI utilization, and green transformation.

When a new Outside Director or a new Outside Audit & Supervisory Board Member assumes their post at the Company, they are instructed on the Company's corporate philosophy, lines of business, finances, organizations, etc. In addition, the Company will prepare opportunities to ensure that they can deepen their understanding of the Company, such as through interaction with Directors, Managing Officers and employees at the Company, attendance at various meetings related to business operations and management, and participation in factory inspections.

Committee on Personnel and Remuneration, etc.

To enhance transparency and objectivity in electing candidates for Directors and Audit & Supervisory Board Members, as well as deciding remuneration of Directors, the Company has voluntarily established the Committee on Personnel and Remuneration, etc. A majority of its members are Outside Directors.

The Committee on Personnel and Remuneration, etc. discusses issues such as election standards and adequacy of candidates for the position of Director or Audit & Supervisory Board Member, as well as the adequacy of the system and level of Directors' remuneration. The results of these discussions form the basis for decisions made by the Board of Directors. The Board of Directors also delegates decisions on some matters to the Committee.

Decisions made by the Board of Directors for the election of senior Managing Officers and the remuneration of Managing Officers are also based on the results of the Committee's deliberations.

The main issues reviewed were as follows:

- Appropriateness of policy for determination of individual remuneration, etc. of Directors in FY2024

- Determination of the specific details of basic remuneration for each individual Director in FY2024

(the Board of Directors delegated this determination to the Committee on Personnel and Remuneration, etc.) - Appropriateness of policy and procedures for determining the remuneration of Managing Officers in FY2024

- Suitability of candidates for Directors to be proposed at the Annual General Meeting of Shareholders held in June 2025

- Appropriateness of content of revised remuneration for Directors to be proposed at the Annual General Meeting of Shareholders held in June 2025

- Appropriateness of policy for determination of individual remuneration, etc. of Directors after the Annual General Meeting of Shareholders held in June 2025

- Future candidates for Outside Directors

Key Experience, Knowledge and Expertise of Directors and Audit & Supervisory Board Members

(from June 27, 2025)

| Board of Directors |

Audit & Supervisory Board |

Committee on Personnel and Remuneration, etc. |

Corporate Management*1 |

Technology / R&D / Procurement / Manufacturing / Quality |

Sales / Marketing |

Finance / Accounting |

Legal / Risk management |

ESG / Sustainability |

HR development / Labor relations / HR |

Overseas business / International experience*2 |

IT & Digital |

||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Number of meetings attended / Number of meetings held in FY2024) |

|||||||||||||

| Representative Director and President |

Toshihiro Suzuki | ● 14/14 times |

● 5/5 times |

⊚ | ○ | ○ | ○ | ○ | |||||

| Representative Director and Executive Vice President |

Naomi Ishii | ● 14/14 times |

● 5/5 times |

⊚ | ○ | ○ | ○ | ⊚ | ○ | ||||

| Director and Executive Vice President |

Katsuhiro Kato*1 | ● 11/11 times |

○ | ○ | ○ | ||||||||

| Director and Senior Managing Officer |

Aritaka Okajima*1 | ● 11/11 times |

⊚ | ○ | ○ | ||||||||

| Director and Senior Managing Officer |

Eiichi Muramatsu*2 | ● | ⊚ | ○ | |||||||||

| Outside Director Independent Director |

Hideaki Domichi | ● 14/14 times |

● 5/5 times |

○ | ○ | ○ | ○ | ⊚ | |||||

| Outside Director Independent Director |

Shun Egusa | ● 14/14 times |

● 5/5 times |

○ | ○ | ○ | |||||||

| Outside Director Independent DirectorFemale |

Naoko Takahashi | ● 13/14 times |

● 5/5 times |

○ | ⊚ | ||||||||

| Outside Director Independent DirectorFemale |

Asako Aoyama*2 | ● | ● | ○ | ○ | ○ | ○ | ○ | |||||

| Full-time Audit & Supervisory Board Member |

Taisuke Toyoda | ● 14/14 times |

● 16/16 times |

○ | ○ | ○ | |||||||

| Full-time Audit & Supervisory Board Member |

Shigeo Yamagishi*3 | ● 11/11 times |

● 13/13 times |

○ | ○ | ○ | ○ | ||||||

| Outside Audit & Supervisory Board Member Independent Director |

Norihisa Nagano | ● 14/14 times |

● 16/16 times |

▲ 5/5 times |

○ | ||||||||

| Outside Audit & Supervisory Board Member Independent Director |

Mitsuhiro Fukuta | ● 13/14 times |

● 16/16 times |

▲ 5/5 times |

○ | ○ | |||||||

| Outside Audit & Supervisory Board Member Independent DirectorFemale |

Junko Kito*4 | ● 11/11 times |

● 13/13 times |

▲ 4/4 times |

○ | ○ | |||||||

- ●: Committee member ▲: Observer

- *1 ⊚: Experience as President, ○: Experience as executive officer

- *2 ⊚: Experience in India / emerging countries

- Note:

- *1 Katsuhiro Kato and Aritaka Okajima were appointed as Directors on June 27, 2024. Attendance records cover the Board of Directors meetings held after assuming their posts as Directors.

- *2 Eiichi Muramatsu and Asako Aoyama were appointed as Directors on June 27, 2025.

- *3 Shigeo Yamagishi was appointed as an Audit & Supervisory Board Member on June 27, 2024. Attendance records cover the Board of Directors and Audit & Supervisory Board meetings held after assuming his post as an Audit & Supervisory Board Member.

- *4 Junko Kito was appointed as Audit & Supervisory Board Member on June 27, 2024. Attendance records cover the Board of Directors, Audit & Supervisory Board, and Committee on Personnel and Remuneration, etc. meetings held after assuming her post as an Audit & Supervisory Board Member.

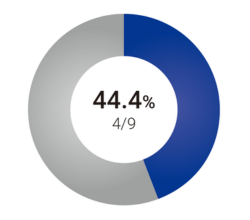

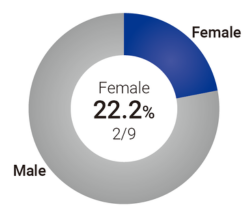

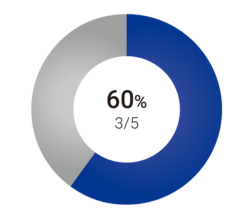

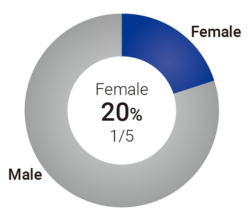

Outside Directors & Gender Representation among Directors

■Outside Directors

■Gender Representation among Directors

■Outside Audit & Supervisory

Board Members

■Gender Representation among Audit & Supervisory Board Members

Executive Committee and Other Meetings Relating to Business Operation and Management

In order to speedily deliberate and decide on important management issues and measures, the Company holds Executive Committee meetings, attended by Executive Directors, Managing Officers, Executive General Managers, and Audit & Supervisory Board Members, as well as meetings to report and share information on management and business execution on a regular and as-needed basis.

Various meetings are also held periodically and whenever necessary to deliberate on business plans, etc. and to receive monthly reports on operation of the Company, enabling the Company to appropriately plan, identify issues at an early stage, and grasp the situation on execution of operations.

Such meetings help to enhance the efficiency of decision-making at Board of Directors meetings and supervision of business execution.

Corporate Governance Committee

The Corporate Governance Committee, the meetings of which are attended by Executive Directors, Managing Officers, Executive General Managers, and Audit & Supervisory Board Members, was established to examine matters to ensure compliance and risk management, as well as to promote the implementation of measures and policies. The Committee also verifies the results of the effectiveness evaluation of internal controls over financial reporting in accordance with Article 24-4-4, Paragraph 1 of the Financial Instruments and Exchange Act.

Internal Auditing

The Audit Division was established as an organization under the direct control of the President, whose staff members with expertise in various areas of the Company's operations regularly audit the Company's departments and domestic and overseas Group companies in accordance with the audit plan, while also providing advice and guidance on improvements regarding audit findings.

Operational audits include onsite, remote, and paper audits to confirm the appropriateness and efficiency of overall operations, compliance with laws and regulations and internal rules, and the development and operation of internal controls, such as the management and maintenance of assets. The operational audit results, along with proposals for improvement of matters pointed out, are reported to the President and the head of relevant divisions each time an audit is conducted. Audit results are also reported to the Audit & Supervisory Board and opinions are exchanged there, as well as to the Board of Directors once every six months. Advice and guidance are provided until improvements are completed in an effort to correct issues at an early stage.

For subsidiaries with internal audit divisions, Suzuki's internal auditing checks their activities, receives reports on their audit plans and results, and provides advice and guidance as necessary.

Furthermore, audit results are shared with the accounting auditor as needed, and regular meetings are held to share information, enhance communication, and maintain close cooperation.

Policy on Directors' and Audit & Supervisory Board Members' Remuneration

Remuneration of Directors

The Company approved the revision of remuneration for Directors at the 159th Annual General Meeting of Shareholders held on June 27, 2025, with the aims of further increasing incentives to meet the management targets set in the Mid-Term Management Plan “By Your Side” announced in February 2025 and enhancing the Company's medium- to long-term corporate value, as well as to promote greater sharing of value between eligible Directors and shareholders.

The following is an overview of the policy for determining individual remuneration, etc. for Directors in FY2025, as determined by a resolution of the Board of Directors following consultation with the Committee on Personnel and Remuneration, etc.

Remuneration of Directors (excluding Outside Directors) consists of basic remuneration, bonuses offered as short-term incentives, and stock remuneration offered as medium- to long-term incentives to encourage continuous improvement of the Company's corporate value. The ratio is roughly 30% basic remuneration, 35% bonuses, and 35% stock remuneration.

Remuneration of Outside Directors consists solely of basic remuneration, in view of the duties entailed by the role.

■Resolution at the General Meeting of Shareholders on Remuneration of Directors, etc.

| Before revision | After revision on June 27, 2025 | |

|---|---|---|

| Basic remuneration | Up to 750 million yen per year (of which, up to 50 million yen per year for Outside Directors) |

Annual amount up to 1,050 million yen (of which, up to 150 million yen per year for Outside Directors) |

| Bonuses (excluding Outside Directors) |

||

| Stock remuneration (excluding Outside Directors) |

Restricted stock

|

Performance-linked, restricted stock

|

Method for Determining Amount of Basic Remuneration Paid, etc.

Basic remuneration of Directors is fixed monthly remuneration, which is determined and paid in consideration of duties and responsibilities, remuneration levels at other companies, and employee salary levels. Determination of the specific details of basic remuneration for individuals is delegated to the Committee on Personnel and Remuneration, etc. based on resolutions of the Board of Directors.

Method for Determining Bonuses, etc.

Bonuses are paid to Directors (excluding Outside Directors) to heighten awareness of improving performance for each fiscal year and to serve as an incentive toward achieving the management goals set in the Mid-Term Management Plan “By Your Side”. The specific amount of remuneration for each individual, paid at a fixed time every year, is calculated by multiplying the performance indicators predetermined by the Board of Directors after consultation with the Committee on Personnel and Remuneration, etc. by a stipulated percentage and the multiplication rate based on position as predetermined by the Board of Directors.

Method for Determining Performance-linked, Restricted Stock Remuneration

Restricted stock is delivered to Directors (excluding Outside Directors) to serve as an incentive toward achieving the management goals set in the Mid-Term Management Plan “By Your Side” and enhancing the Company's medium- to long-term corporate value, in addition to promoting greater sharing of value with shareholders. The specific number of shares granted to each individual shall be calculated by linking the achievement level of financial and non-financial performance evaluation indicators for the performance evaluation period (each fiscal year), which are established annually for each fiscal year based on medium- to long-term management plans and issues to be resolved, to the standard number of shares to be issued as determined in advance by the Board of Directors according to position, responsibilities, and other factors, following consultation with the Committee on Personnel and Remuneration, etc. Each year, at a fixed time following the conclusion of the performance evaluation period, monetary compensation claims are issued for the purpose of granting shares. Each eligible Director receives delivery of the Company's common stock by paying such monetary compensation claims in full as in-kind contributed property. The transfer restriction period is until the date of retirement from the position of Director at the Company. If a Director falls under certain grounds, such as the Director retiring for any reason other than that deemed reasonable by the Board of Directors, the Company shall acquire the shares allotted for no fee.

Furthermore, the Company has established a “malus and clawback provision” allowing it to request the return of all or part of the shares held by an eligible Director, or the Company's common shares for which the transfer restriction has been lifted, in the event that the Board of Directors recognizes a tort or violation of laws and regulations by an eligible Director after the transfer restriction period or lifting of the transfer restriction.

■Remuneration for Directors Excluding Outside Directors in FY2025 (After the Annual General Meeting of Shareholders Held on June 27, 2025)

| Approximate percentage | Evaluation indicator | |

|---|---|---|

| Basic remuneration | 30% | ― |

| Bonuses | 35% |

|

| Performance-linked, restricted stock remuneration |

35% |

|

Remuneration of Audit & Supervisory Board Members

The remuneration of Audit & Supervisory Board Members is limited to basic remuneration (monthly fixed remuneration), and is determined and paid based on consultations with Audit & Supervisory Board Members.

■Remuneration in FY2024 (actual)

| Executive category | Total remuneration (millions of yen) |

Remuneration by type (millions of yen) | Number of eligible officers |

||

|---|---|---|---|---|---|

| Basic remuneration | Bonuses | Restricted stock remuneration |

|||

| Directors (excluding outside Directors) |

747 | 220 | 299 | 277 | 8 |

| Outside Directors | 45 | 45 | ― | ― | 3 |

| Total | 793 | 266 | 299 | 277 | 11 |

| Audit & Supervisory Board members (excluding Outside Audit & Supervisory Board Members) |

70 | 70 | ― | ― | 3 |

| Outside Audit & Supervisory Board Member |

45 | 45 | ― | ― | 4 |

| Total | 116 | 116 | ― | ― | 7 |

- Notes:

- 1. The above remuneration for Directors (excluding Outside Directors) includes the amount paid to three Directors who retired with the completion of their terms as of the conclusion of the 158th Annual General Meeting of Shareholders held on June 27, 2024.

- 2. The above remuneration for Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) includes the amount paid to one Audit & Supervisory Board Member who retired with the completion of their term as of the conclusion of the 158th Annual General Meeting of Shareholders held on June 27, 2024.

- 3. The above remuneration for Outside Audit & Supervisory Board Members includes the amount paid to one Outside Audit & Supervisory Board Member who retired with the completion of their term as of the conclusion of the 158th Annual General Meeting of Shareholders held on June 27, 2024.

- 4. The bonus and restricted stock remuneration are the amounts recorded as expenses in FY2024.

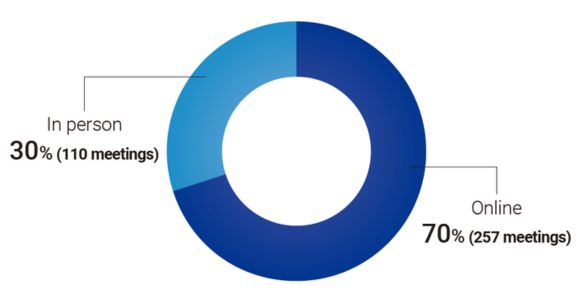

Dialogue with Shareholders

The Company is striving to promote dialogue with its shareholders in the belief that understanding the interests and concerns of shareholders through constructive dialogue from a medium- to long-term perspective will contribute to the Company's sustainable growth and the medium-to-long-term enhancement of its corporate value.

In FY2024, the Director in charge of IR handled 61 out of 367 meetings held (17%).

Opinions, interests and concerns obtained through meetings with shareholders are reported to management in an appropriate manner and utilized in promoting the Company's sustainable growth and medium- to long-term enhancement of its corporate value, as well as in formulating the Mid-Term Management Plan.

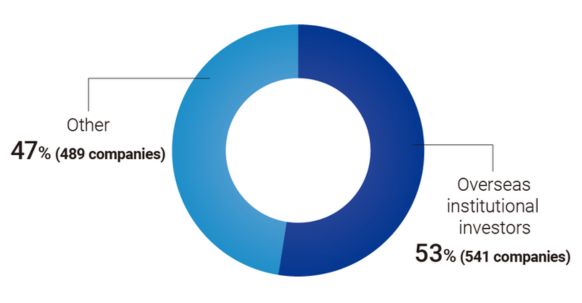

■FY2024 Results

| Meetings held | Total | 367 |

|---|---|---|

| ESG meetings | 19 | |

| Number of companies | 1,030 | |

| Number of people | 1,437 | |

■Types of Meeting

■Meeting Attendees

■Key dialogue topics in meetings held in FY2024

| Themes of regular meetings | Themes of ESG meetings |

|---|---|

|

|

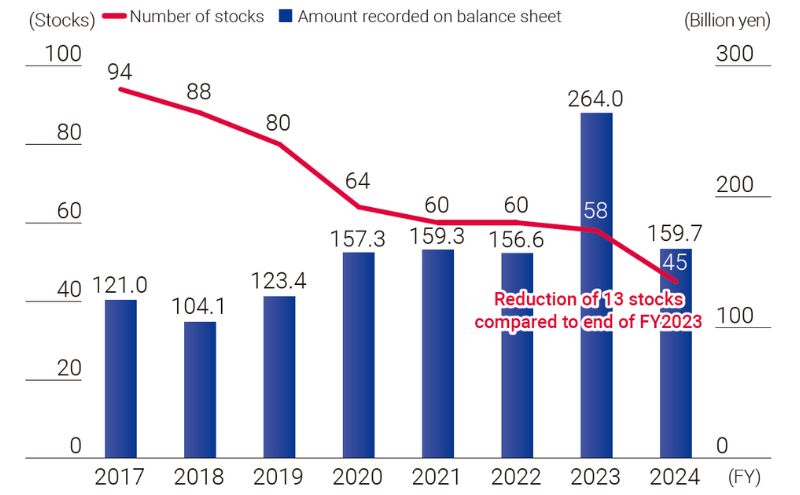

Cross-Shareholdings

For the Company's sustainable growth and the medium- to long-term enhancement of its corporate value, Suzuki may hold shares of business partners, etc. when deemed beneficial for creating business opportunities, forming business alliances, and building, maintaining and strengthening transactional and cooperative relationships.

The appropriateness of individual cross-shareholdings is examined by the Board of Directors every year. The Company makes a comprehensive judgment on the accompanying benefits, risks, and other factors of holdings, taking into consideration the nature, scale and other factors of transactions, and setting qualitative criteria, including aspects of enhancement of corporate value, as well as quantitative criteria, including comparison with capital costs. The Company then reduces crossshareholdings in the stocks it has decided to sell.

■Change in Number of Cross-Shareholdings of Listed Companies and Amount Recorded on the Balance Sheet

Japan

Japan