Corporate governance

Basic policy on corporate governance

Through fair and efficient corporate activities, Suzuki aims to earn the trust of our shareholders, customers, suppliers, local communities, employees, and other stakeholders, and to make further contribution to the international community in order to continue to grow and develop as a sustainable company. To achieve this goal, the Company recognizes that continuous improvement of corporate governance is essential, and as a top priority management issue, we are actively working on various measures.

In consideration of the meaning of the respective principles of the Corporate Governance Code as established by the Tokyo Stock Exchange, Suzuki will make continuous efforts to ensure the rights and equality of shareholders and the effectiveness of the Board of Directors and the Audit & Supervisory Board, as well as to upgrade the internal control system.

Also, in order to be trusted further by society and stakeholders, we will disclose information immediately in a fair and accurate manner prescribed by laws and regulations and actively disclose information that we consider is beneficial to deepen their understanding of the Company. Thus, we will further enhance the transparency of the Company.

- Corporate Governance Report

- https://www.globalsuzuki.com/ir/library/governance/pdf/report.pdf

Outline of the corporate governance system

With the Audit & Supervisory Board System as its foundation, Suzuki has adopted the current corporate structure based on the belief that appointing multiple highly independent Outside Directors, ensuring that the majority of Auditors are Outside Auditors, and establishing an optional committee to handle the nomination of Director candidates and decisions on remuneration will enhance the Company’s governance framework.

■ Corporate governance system

(As of the end of September 2024)

■ Corporate governance initiatives

(FY)

| Through 2014 |

2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | From 2024 |

|||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Management planning and strategy | Mid-Term Management Targets | Mid-Term Management Plan—SUZUKI NEXT 100 | Mid-Term Management Plan—“Sho-Sho-Kei-Tan-Bi (Smaller, Fewer, Lighter, Shorter, Beauty)” | ||||||||||||

| Growth Strategy for FY2030 | |||||||||||||||

| Directors | |||||||||||||||

| Term | 1-year terms for Directors since 2002 | ||||||||||||||

| Supervision / execution | Introduced a managing officer system in 2006 (number of Directors decreased from 29 to 14) | ||||||||||||||

| Number of members | Since June 2013: 9 | 8 | 9 | 8 | |||||||||||

| Number of Outside Directors | Since June 2012: 2 | 3 | |||||||||||||

| Audit & Supervisory Board Members | |||||||||||||||

| Number of members | Since 2001: 5 (Outside Audit & Supervisory Board Members: 3) | ||||||||||||||

Board of Directors

The Company adopted a managing officer system in 2006 with the aim of speeding up decision-making at the Board of Directors, executing business flexibly and clarifying accountability, and has made progress in slimming the composition of the Board of Directors. Currently, there are eight Directors, and out of them, three Outside Directors are elected so that the Company can strengthen the Board’s function to supervise business management and have Outside Directors offer useful advice, suggestions, etc. on the Company’s business management, based on their respective experience and knowledge and from their diverse perspectives.

In principle, the Board of Directors meets once a month. It works to strengthen supervision by making decisions on basic management policies, important business execution matters, matters authorized by the General Meeting of Shareholders to the Board of Directors, and other matters stipulated by law and regulations and the Articles of Incorporation based on sufficient discussion, including from the perspective of legal compliance and corporate ethics, as well as receiving reports on the execution of important business operations as appropriate.

In order to clarify managerial accountability for individual Directors and flexibly respond to the changing business environment, the term of each Director is set at one year.

■ Composition of resolution matters in Board of Directors meetings

■ Composition of reporting matters in Board of Directors meetings

■ Examples of Board of Directors meeting agenda

| Management issues |

|

|---|---|

| Governance |

|

| Personnel and organization |

|

| Financial results-related |

|

Board evaluation

The Company conducts an annual analysis and evaluation to improve the effectiveness of the Board of Directors. An outline of the FY2023 analysis and evaluation is as follows.

1. Method of analysis and evaluation (conducted February to June 2024)

The Company focused on the Board of Directors’ challenges in enhancing Suzuki’s competitiveness.

- (1) Interviews with all Directors and Audit & Supervisory Board Members

- (2) Opinions exchanged between the Representative Directors, Outside Directors and Outside Audit & Supervisory Board Members, primarily around Suzuki’s challenges

- (3) Future initiatives discussed by the execution side based on opinions of the Outside Directors and Outside Audit & Supervisory Board Members

- (4) Future initiatives deliberated and confirmed by the Board of Directors

2. Outline of results

Based primarily on findings from the Outside Directors and Outside Audit & Supervisory Board members, the following were identified as priority issues for FY2024:

Suzuki plans to announce a new Mid-Term Management Plan by the end of FY2024 to achieve its Growth Strategy for FY2030 (announced in January 2023). To contribute to constructive discussions on the Company’s strategic orientation, which is the primary role and responsibility of the Board of Directors, efforts will be made to further enhance the effectiveness of the Board, including addressing these priority issues.

- (1) Expand discussion and deliberation regarding strategy

- (2) Agenda management from submission to internal meeting bodies to submission to the Board of Directors

- (3) Feedback on the status of responses to findings raised at Board of Directors meetings

[Ref.] Priority issues from the previous (FY2022) analysis and evaluation and results of initiatives in FY2023

<Priority issues>

- (1) Selection of themes to be deliberated, resolved and reported

- (2) Schedule management and advance preparation for submissions to the Board of Directors

- (3) Timing of prior distribution of materials; how materials are to be written and explained

<Results of initiatives>

(Opinions of Outside Directors and Outside Audit & Supervisory Board Members)

- Themes are being selected with growth in mind.

- No particular problems with operations or preparation of materials.

- Discussions by internal meeting bodies other than the Board of Directors are open to Outside Directors, allowing them to participate in discussions by the Board with an understanding of background and progress to date.

<Ongoing issues>

- Securing appropriate time for discussion.

Audit & Supervisory Board

The Audit & Supervisory Board aims to establish a quality corporate governance system in collaboration with the Board of Directors, one that responds to the public trust and that ensures sound and sustained growth for the Company and its Group companies, and creates medium- to long-term corporate value. As a stand-alone body, it conducts audits to ensure the proper management and offers appropriate opinions to the management team.

1. Structure and procedures of the Audit & Supervisory Board

The Audit & Supervisory Board consists of five members: two full-time Audit & Supervisory Board Members with business experience, and three Outside Audit & Supervisory Board Members with advanced expertise and extensive experience in areas such as finance, accounting, legal affairs, and technology. Their audits are conducted from a variety of perspectives.

The audit procedures of Audit & Supervisory Board Members conform to the auditing standards established by the Audit & Supervisory Board and are conducted according to the auditing policy and division of duties. Audit & Supervisory Board Members audit the proper execution of corporate management and communicate their opinions by attending meetings of the Board of Directors and other important meetings, inspecting important approval documents, etc., and receiving reports and conducting interviews with Directors and employees on the status of operations.

2. Activities of the Audit & Supervisory Board

In principle, the Company holds meetings of its Audit & Supervisory Board once a month, and otherwise as needed.

Further, Audit & Supervisory Board Members exchange opinions among themselves in advance regarding agenda items for the Board of Directors in an effort to ensure they can offer meaningful opinions at meetings of the Board.

- (1) Priority audit items for FY2023 included verifying the establishment and operation of an internal control system, focusing on the management and operations involving human capital; the establishment and operation of a system regarding profit and loss and cost management of individual models; and the development of management and supervisory systems for outsourced development of automotive technology.

- (2) A meeting to exchange opinions was held with the Representative Directors and Outside Directors to discuss a wide range of topics, including management challenges and risk awareness. At the same time, exchanges of opinions with the management of subsidiaries were conducted to confirm the operational status of Group governance systems.

■ Examples of Audit & Supervisory Board agenda items

| Resolutions |

|

|---|---|

| Reports |

|

| Review and Deliberations |

|

Effectiveness evaluation of the Audit & Supervisory Board

The Audit & Supervisory Board evaluates its effectiveness by having each member review their activities, conducting evaluations via a checklist, and providing opinions and suggestions by means of surveys. These are discussed and examined collectively by all Members, and the findings are reflected in the next audit plan as action items in an effort to continually improve effectiveness.

Independence of Outside Directors and Outside Audit & Supervisory Board Members

Concerning the independence from the Company with regard to the election of Outside Directors and Outside Audit & Supervisory Board Members, the Company judges their independence under the Company’s “Standard for Independence of Outside Directors and Outside Audit & Supervisory Board Members of the Company” based on independence criteria set by the Tokyo Stock Exchange. Suzuki reports all the elected Outside Directors and Outside Audit & Supervisory Board Members to the Tokyo Stock Exchange as independent officers.

<Standard for Independence of Outside Directors and Outside Audit & Supervisory Board Members>

The Company judges an independent person who does not fall under any of the following as an Outside Director or an Outside Audit & Supervisory Board Member:

1. Persons concerned with the Company and its subsidiaries (“the Suzuki Group”)

- (1) With regard to Outside Directors, any person who is or was a person executing business*1 of the Suzuki Group at present or in the past,

- (2) With regard to Outside Audit & Supervisory Board Members, any person who is or was a Director, Managing Officer, or employee of the Suzuki Group at present or in the past, or

- (3) A spouse or a relative within the second degree of kinship of a present Director or Managing Officer of the Suzuki Group

2. Persons concerned such as business partners or major shareholders, etc.

- (1) Any person who is a person executing business of any of the following:

- 1) A company whose major business partner is the Suzuki Group*2

- 2) A major business partner of the Suzuki Group*3

- 3) A major shareholder holding 10% or more of the total voting rights of the Company

- 4) A company in which the Suzuki Group holds 10% or more of the total voting rights

- (2) A person who is or was a representative partner or a partner of the Suzuki Group’s Accounting Auditor at present or in the past five years

- (3) A person who receives a large amount of remuneration from the Suzuki Group other than remuneration for Director / Audit & Supervisory Board Member*4

- (4) A person who receives a large donation from the Suzuki Group*5

- (5) A spouse or relative within the second degree of kinship of a person who falls under categories (1) through (4) above

- Notes

-

- 1. A person executing business:

An Executive Director, an executive officer, a Managing Officer or an employee - 2. A company whose major business partner is the Suzuki Group:

A company which belongs to the group of a business partner who has received 2% or more of its consolidated net sales in the group’s latest fiscal year from the Suzuki Group in any of the past three fiscal years - 3. A major business partner of the Suzuki Group:

A company which belongs to the group of a business partner who has paid 2% or more of the Suzuki Group’s consolidated net sales or provides loans to the Suzuki Group worth 2% or more of its consolidated total assets in the Suzuki Group’s latest fiscal year in any of the past three fiscal years - 4. A person who receives a large amount of remuneration:

In any of the past three fiscal years:- A consultant or legal or accounting expert, etc., who receives annual remuneration of ¥10 million or more other than remuneration as a Director / Audit & Supervisory Board Member, as an individual

- A consultant or legal or accounting expert, etc., who belongs to an organization that receives annual remuneration worth 2% or more of its annual total revenues

- 5. A person who receives a large donation:

In any of the past three fiscal years:- A person who receives an annual donation of ¥10 million or more as an individual

- A person who belongs to an organization that receives an annual donation worth 2% or more of its annual total revenues and manages the activities that are the purpose of the donation

- 1. A person executing business:

Training for Directors and Audit & Supervisory Board Members

The Company provides training sessions to help Directors and Audit & Supervisory Board Members deepen their understanding of their roles and responsibilities. We intend to make the training an opportunity in which Directors and Audit & Supervisory Board Members take part together, in principle, so that they can share information on their respective roles, responsibilities, etc.

When a new Outside Director or a new Outside Audit & Supervisory Board Member assumes post in the Company, the Company will explain to the person the corporate philosophy, lines of business, finances, organizations, etc. In addition, the Company will prepare opportunities, such as interaction with Directors, Managing Officers and employees in the Company, attendance at various meetings related to business operation and management, and joining of factory inspections, to ensure that the person can deepen their understanding of the Company.

Committee on Personnel and Remuneration, etc.

To enhance transparency and objectivity in electing candidates for Directors and Audit & Supervisory Board Members, as well as deciding remuneration of Directors, the Company has established the Committee on Personnel and Remuneration, etc. as an optional committee. A majority of the members are Outside Directors.

The Committee on Personnel and Remuneration, etc. discusses issues such as election standards and adequacy of candidates for Directors and Audit & Supervisory Board Members, as well as the adequacy of the system and level of Directors’ remuneration. The Board of Directors decides based on their results. Also, the Board of Directors delegates decisions on some matters to the Committee.

Decisions made by the Board of Directors for the election and remuneration of Senior Managing Officers are also based on the results of the Committee’s deliberation.

The main issues reviewed in FY2023 were as follows:

- Appropriateness of policy for determination of individual remuneration, etc. of Directors in FY2023

- Determination of the specific details of basic remuneration for each individual Director in FY2023 (the Board of Directors has delegated this determination to the Committee on Personnel and Remuneration, etc.)

- Appropriateness of policy and procedures for determining the remuneration of Managing Officers in FY2023

- Suitability of candidates for Directors and Audit & Supervisory Board Members to be proposed at the Annual General Meeting of Shareholders to be held in June 2024.

■ Members attending meetings of the Board of Directors, Audit & Supervisory Board, and Committee on Personnel and Remuneration, etc.

(as of June 27, 2024) and attendance in FY2023

Knowledge and expertise of Directors and Audit & Supervisory Board Members

- *1 ◎ : Experience as President, ○ : Experience as executive officer

- *2 ◎ : Experience in India / emerging countries

| Board of Directors | Audit & Supervisory Board | Committee on Personnel and Remuneration, etc. | Corporate management*1 | Technology / R&D / Procurement / Manufacturing / Quality | Sales / Marketing | Finance / Accounting | Legal / Risk management | ESG / Sustainability | HR development / Labor relations / HR | Overseas business / International experience*2 | IT / Digital | |||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Representative Director and President | Toshihiro Suzuki | ○ 17 times / 17 times |

○ 5 times / 5 times |

◎ | ○ | ○ | ○ | ○ | ||||||

| Representative Director and Executive Vice President | Naomi Ishii | *1 | ○ 14 times / 14 times |

○ 3 times / 3 times |

◎ | ○ | ○ | ○ | ◎ | ○ | ||||

| Director and Senior Managing Officer | Katsuhiro Kato | *2 | ○ | ○ | ○ | ○ | ||||||||

| Director and Senior Managing Officer | Shigetoshi Torii | *2 | ○ | ◎ | ○ | ○ | ◎ | |||||||

| Director and Managing Officer | Aritaka Okajima | *2 | ○ | ◎ | ○ | |||||||||

| Outside Director | Hideaki Domichi Independent |

○ 17 times / 17 times |

○ 5 times / 5 times |

○ | ○ | ○ | ○ | ◎ | ||||||

| Outside Director | Shun Egusa Independent |

○ 17 times / 17 times |

○ 5 times / 5 times |

○ | ○ | ○ | ||||||||

| Outside Director | Naoko Takahashi Independent Female |

*1 | ○ 13 times / 14 times |

○ 2 times / 3 times |

○ | ◎ | ||||||||

| Full-time Audit & Supervisory Board Member | Taisuke Toyoda | ○ 17 times / 17 times |

◎ 13 times / 13 times |

○ | ○ | ○ | ||||||||

| Full-time Audit & Supervisory Board Member | Shigeo Yamagishi | *3 | ○ | ○ | ○ | ○ | ○ | ○ | ||||||

| Outside Audit & Supervisory Board Member | Norihisa Nagano Independent |

○ 17 times / 17 times |

○ 13 times / 13 times |

△ 5 times / 5 times |

○ | |||||||||

| Outside Audit & Supervisory Board Member | Mitsuhiro Fukuta Independent |

○ 16 times / 17 times |

○ 12 times / 13 times |

△ 4 times / 5 times |

○ | ○ | ||||||||

| Outside Audit & Supervisory Board Member | Junko Kito Independent Female |

*3 | ○ | ○ | △ | ○ | ○ | |||||||

| ○ : Committee member △:Observer |

||||||||||||||

- Notes:

-

- 1. Mr. Naomi Ishii and Ms. Naoko Takahashi were appointed as Directors on June 23, 2023.

Attendance records cover the Board of Directors and Committee on Personnel and Remuneration, etc. meetings held after assuming posts as Directors. - 2. Mr. Katsuhiro Kato, Mr. Shigetoshi Torii and Mr. Aritaka Okajima were appointed as Directors on June 27, 2024.

- 3. Mr. Shigeo Yamagishi and Ms. Junko Kito were appointed as Audit & Supervisory Board Members on June 27, 2024.

- 1. Mr. Naomi Ishii and Ms. Naoko Takahashi were appointed as Directors on June 23, 2023.

■ Outside Board Members

■ Female Board Members

Executive Committee and other various meetings relating to business operation and management

In order to speedily deliberate and decide on important management issues and measures, the Company holds the Executive Committee, attended by Executive Directors, Managing Officers, Executive General Managers, and Audit & Supervisory Board Members, as well as meetings to report and share information on management and business execution on a regular and as-needed basis.

Also, various meetings are held periodically and whenever necessary to deliberate business plans, etc. and to receive reports on operation of the Company, enabling the Company to appropriately plan, identify administrative issues at an early stage, and grasp the situation on execution of operation.

In such a way, the Company enhances the efficiency of decision-making at the meetings of the Board of Directors and the supervision of execution of operations.

Corporate Governance Committee

The Corporate Governance Committee was established to examine matters to ensure compliance and risk management, as well as to promote the implementation of measures and policies for the Suzuki Group’s sustainable growth and the medium- to long-term enhancement of corporate value. The Committee also verifies the results of the effectiveness evaluation of internal controls over financial reporting in accordance with Article 24-4-4, Paragraph 1 of the Financial Instruments and Exchange Act.

The Committee was restructured in April 2023 to include the President as the Chairperson, the Vice Presidents, some of the Senior Managing Officers and Managing Officers as Vice Chairpersons, and other Managing Officers and the Executive General Managers as members, with Full-time Audit & Supervisory Board Members present as observers, commencing to oversee overall risk management including compliance.

Internal auditing

The Audit Division was established as an organization under the direct control of the President, whose staff members with expertise in various areas of the Company’s operations regularly audit the Company’s departments and domestic and overseas Group companies in accordance with the audit plan, while also providing advice and guidance on improvements regarding audit findings.

Operational audits include on-site, remote, and paper audits to confirm the appropriateness and efficiency of overall operations, compliance with laws and regulations and internal rules, and the development and operation of internal controls, such as the management and maintenance of assets. The operational audit results, along with proposals for improvement of matters pointed out, are reported to the President and the head of relevant divisions each time an audit is conducted. Audit results are also reported to the Audit & Supervisory Board and opinions are exchanged there, as well as to the Board of Directors once every six months. Advice and guidance are provided until improvements are completed in an effort to correct issues at an early stage.

The effectiveness evaluation of internal controls over financial reporting in accordance with Article 24-4-4, Paragraph 1 of the Financial Instruments and Exchange Act is conducted by the Corporate Governance Committee, and the results are reported by the Corporate Governance Committee to the Board of Directors and the Audit & Supervisory Board.

For subsidiaries with internal audit divisions, the Company’s internal auditing checks their activities, receives reports on their audit plans and results, and provides advice and guidance as necessary.

Furthermore, audit results are shared with the Accounting Auditor as needed, and regular meetings are held to share information, enhance communication, and maintain close cooperation.

Policy on Directors’ and Audit & Supervisory Board Members’ remuneration

a. Remuneration of Directors

Regarding the decision-making policy for individual remuneration of Directors (hereinafter, “Decision-making Policy”), the Committee on Personnel and Remuneration, etc., with a majority of the members as Outside Directors, is consulted on the appropriateness of the proposed policy. The Board of Directors deliberates and makes a resolution based on the report. The following is a summary of the Decision-making Policy as of the publication of this data book.

Remuneration of Directors (excluding Outside Directors) consists of basic remuneration, bonuses linked to the Company’s performance of each fiscal year, and restricted stock remuneration to function as an incentive for continuous improvement of the Company’s corporate value resulting in the medium- to long-term stock price. The ratio is roughly 40% basic remuneration, 30% bonuses, and 30% restricted stock remuneration. Outside Directors’ remuneration shall be solely basic remuneration, given their duties.

■ Estimated composition of the remuneration of Directors (excluding Outside Directors)

[Basic remuneration]

Basic remuneration is fixed monthly remuneration, which is determined and paid in consideration of duties and responsibilities, remuneration levels at other companies, and employee salary levels.

[Bonus]

Bonuses are paid to Directors (excluding Outside Directors) in order to raise awareness of improvement of each fiscal year’s performance and function as an incentive for continuous improvement of corporate value. The specific amount of remuneration for each individual is calculated by multiplying the performance indicators predetermined by the Board of Directors by a stipulated percentage and the multiplication rate based on position predetermined by the Board of Directors. The performance indicator is consolidated operating profit from the perspective of company profitability.

[Restricted stock remuneration]

It is paid to Directors (excluding Outside Directors) in order to function as an incentive for continuous improvement of corporate value and to further promote shared value with shareholders. Eligible Directors receive ordinary shares of the Company by paying all remuneration paid based on the resolution of the Board of Directors (monetary remuneration rights) as a contribution in kind. The transfer restriction period is until the date of retirement from the position of Director. If a Director falls under certain grounds, such as the Director retiring for any reason other than that deemed reasonable by the Board of Directors, the Company shall acquire the shares allotted for no fee.

b. Remuneration of Audit & Supervisory Board Members

The remuneration of Audit & Supervisory Board Members shall be limited to basic remuneration (monthly fixed remuneration) and is determined and paid based on consultations with Audit & Supervisory Board Members.

■ Amount of remuneration in FY2023

| Officer classification | Total amount of remuneration (Million yen) |

Total amount of remuneration by type (Million yen) |

Number of eligible officers | ||

|---|---|---|---|---|---|

| Basic remuneration | Bonus | Restricted stock remuneration | |||

| Directors (excluding Outside Directors) |

598 | 213 | 232 | 152 | 7 |

| Outside Directors | 38 | 38 | ― | ― | 3 |

| Total | 636 | 251 | 232 | 152 | 10 |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

64 | 64 | ― | ― | 2 |

| Outside Audit & Supervisory Board Members | 41 | 41 | ― | ― | 3 |

| Total | 106 | 106 | ― | ― | 5 |

- Note:

- The above remuneration for Directors (excluding Outside Directors) includes the amount paid to 2 Directors who retired with the completion of their terms as of the conclusion of the 157th Annual General Meeting of Shareholders held on June 23, 2023.

The bonus and restricted stock remuneration are the amounts recorded as expenses in FY2023.

Dialogue with shareholders and others

In the belief that understanding the interests and concerns of the shareholders through constructive dialogues from a mid- and long-term perspective will contribute to the Company’s sustainable growth and the mid- and long-term enhancement of corporate value, the Company is striving to promote dialogue with its shareholders.

In FY2023, the number of meetings held with shareholders and others totaled 369, involving 1,157 companies and 1,525 participants.

Following are the policies designed to encourage sound dialogue with shareholders.

1. Person in charge of IR

A Director in charge of IR is on-site in Tokyo, with a dedicated department serving as the point of contact for IR inquiries. To support this, a department responsible for preparing disclosure materials, such as financial statements and IR documents, has been set up at the head office.

Dialogue with shareholders and others shall be conducted to a reasonable extent, taking into account shareholder requests and main areas of interest. As a general rule, these engagements shall be handled by Directors or senior management with sufficient knowledge and experience to provide precise explanations.

In FY2023, the Director in charge of IR handled 64 out of 369 meetings (17%).

2. Collaboration with relevant departments

The IR contact department in Tokyo and the IR support department in the head office collaborate with other relevant departments to review and share their understanding in advance based on the topics for dialogue with shareholders and others. Relevant departments may also attend depending on the topic.

3. Dialogue methods

In addition to individual meetings, we hold quarterly financial results briefings for securities analysts and institutional investors, investor conferences in Japan and overseas, and IR events such as new car launch events, business and technical briefings as needed. We also strive to enhance the IR-related materials, including Englishlanguage translations, available on the Company’s website.

Of the 369 meetings held in FY2023, 253 (69%) were conducted online via teleconferences, web meetings, or similar methods.

Online meetings allowed for engagement with numerous overseas institutional investors; among the 1,157 we met with in FY2023, 718 (62%) were overseas institutional investors.

<Key dialogue topics>

Of 369 meetings, 21 (6%) were related to ESG, including meetings with individuals responsible for exercising voting rights.

In normal meetings, the main topics of discussion include the state of our key markets, such as the market for automobiles in India and Japan, our electrification strategy, financial figures, shareholder returns and others, discussions which contribute to enhancing corporate value.

Exchanges of opinions ranged widely in ESG meetings as well, covering topics including measures for carbon neutrality, growth strategies, human rights, women’s empowerment, investments in human capital, and corporate governance, among other topics.

4. Feedback

Opinions, interests and concerns obtained through meetings with shareholders and others are reported to management in an appropriate manner, and utilized in promoting the Company’s sustainable growth and mediumto long-term enhancement of corporate value.

In FY2023, a total of 17 opinions and concerns of shareholders and others were reported to management. In addition, regular meetings with management focusing on IR topics were initiated in the latter half of the fiscal year. These efforts contributed to a qualitative improvement in information disclosure and were reflected in a variety of measures, including the implementation of growth strategy briefings, the appointment of women as Outside Directors, improvements in financial disclosure documents and integrated reports, and the execution of share buybacks, among others.

5. Controlling insider information

Insider information is tightly controlled to prevent leaks outside the Company.

We have established a quiet period of about one month prior to our financial results announcement, during which we limit our dialogue with shareholders and others regarding information on financial results.

During our dialogues with shareholders and others, responses are handled, in principle, by multiple members in the interest of mutual oversight.

6. Fair information disclosure

We strictly observe the Fair Disclosure Rule stipulated in the Financial Instruments and Exchange Act when disclosing information to investors, securities analysts, and other related parties.

■ FY2023 result

| Number of meetings held | Number of companies | Number of people | |

|---|---|---|---|

| Total | Of which, ESG meetings | ||

| 369 | 21 | 1,157 | 1,525 |

■ Type of meeting

■ Ratio of overseas institutional investors attending meetings

Cross-shareholdings

For the Company’s sustainable growth and the mid- to longterm enhancement of corporate value, Suzuki may hold shares of business partners and others when deemed beneficial for creating business opportunities, forming business alliances and building, maintaining, and strengthening transactional and cooperative relationships.

Appropriateness of individual cross-shareholdings is examined by the Board of Directors every year. The Company makes a comprehensive judgment on the accompanying benefits, risks, and other factors of holdings, taking into consideration the nature, scale, and other factors of transactions and setting qualitative criteria, including aspects of enhancement of corporate value, as well as quantitative criteria including comparison with capital costs. The Company will then reduce cross-shareholdings in the stocks it has decided to sell.

Note that as of the end of FY2023, we have identified four stocks which will be subject to sale during FY2024.

■ Change in the number of cross-shareholdings of listed companies

Compliance

Basic policy

For the Suzuki Group to achieve sustainable growth and development, it must be trusted by society, and its activities need to be supported and understood. For this purpose, Suzuki recognizes that it is essential to not only comply with laws and internal regulations, but also adhere to social norms and carry out activities based on high ethical standards.

On the basis of the tradition and spirit passed down since the Company’s founding, in 1962 Suzuki established the Mission Statement, which expresses the corporate philosophy of “what kind of company we seek to become” with the aim of sharing values throughout the Suzuki Group. (Please refer to Corporate Philosophy for details.)

In 2016, Suzuki formulated the Suzuki Group Code of Conduct in line with the spirit of the Mission Statement, as a set of rules for enabling all persons working in the Suzuki Group to dedicate themselves to their duties healthily, efficiently, and energetically. This Code of Conduct has been made into a booklet so that all Suzuki Group employees can carry it at all times. Besides a Japanese version, English and Portuguese versions have been created and distributed to non-Japanese employees working in Japan. Also, at overseas subsidiaries, booklets written in the respective local native languages are distributed to employees.

Furthermore, based on the Code of Conduct, in 2020 Suzuki created and distributed the Compliance Handbook to all employees in Japan. This handbook specifically summarizes what people working in the Suzuki Group must and must not do from the perspective of compliance. Along with a Japanese version, Suzuki also created English and Portuguese versions of the handbook to enable employees to confirm and review their conduct at any time in their daily work.

Compliance system

● Corporate Governance Committee

Suzuki has established the Corporate Governance Committee, which directly reports to the Board of Directors. The Committee examines matters to ensure compliance and risk management, as well as to promote measures and policies to address cross-organizational issues in cooperation with related departments. The Committee also verifies the results of the effectiveness evaluation of internal controls over financial reporting in accordance with Article 24-4-4, Paragraph 1 of the Financial Instruments and Exchange Act.

Following the resolution of the Board of Directors in March 2023, the Committee was restructured in April 2023 to include the President as Chairperson, the Vice Presidents, some of the Senior Managing Officers and Managing Officers as Vice Chairpersons, and other Managing Officers and the Executive General Managers as members, with Full-time Audit & Supervisory Board Members present as observers, commencing to oversee overall risk management including compliance. Also, in June and July 2024, following resolutions by the Board of Directors, the structure and agenda items of the Committee and the executive and business operations committees were reorganized and clarified to enhance timely reporting to management and the effectiveness of deliberations.

The Committee engages in enhancement of compliance awareness by employees and urges caution for individual legal compliance throughout the Company. Furthermore, if compliance issues arise, the Committee deliberates each issue, formulates required measures, and reports the details to Directors and Audit & Supervisory Board Members as appropriate.

● Whistleblowing system

(Suzuki Group Risk Management Hotline)

With the aim of preventing and promptly addressing noncompliance matters, Suzuki has established whistleblowing hotlines (Suzuki Group Risk Management Hotline; two internal hotlines and one external hotline (law firm)) based on a whistle blowing system. The hotlines accept reports from all Suzuki Group executives and employees (including temporary employees, fixed-term contract employees, and retired employees), regardless of whether in Japan or overseas, and from external parties such as business partners and contractors. Rules for whistleblower protection have been established at whistleblowing hotlines, covering matters such as protecting the anonymity of whistleblowers and maintaining the confidentiality of report content, thereby establishing a system that allows whistleblowers to report on breach of laws and regulations or their possibility without facing any disadvantageous treatment.

Suzuki has also conducted a survey on awareness and use of the whistleblowing system and conducts initiatives to ensure employees’ opinions lead to improvements.

The number of whistleblowing cases in the past five years (FY2019–FY2023) is as follows:

■ Trends in the number of whistleblowing cases*

* Total of compliance-related cases only

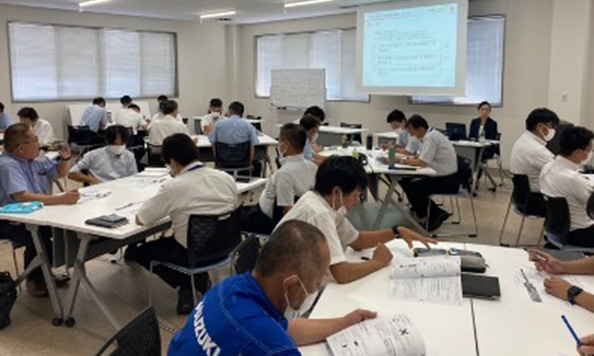

Compliance-related education

The Suzuki Group offers internal compliance-related education and training. Primarily through rank-based group training, education programs suited to each level, from newly hired employees to management supervisors, are selected and implemented on a systematic, ongoing basis.

■ FY2023 results

| Scope | Suzuki Motor Corporation | Suzuki Group domestic distributors and Group sales companies, etc. |

|---|---|---|

| Number of participants | 1,169 | 3,886 |

| Scope of training |

|

|

| Main topics | Labor management, safety and health management, fire prevention management, whistleblowing, harassment, intellectual property (copyright, etc.), Subcontract Act, and security export control, among other topics | |

● Daily compliance quiz

To foster a culture of everyday awareness of compliance, an e-learning program that displays one compliance-related quiz question a day when employees and executives start up their work computers has been running daily since June 2017.

Compliance-related initiatives

● Status of measures to prevent recurrence of improper conduct during final vehicle inspections

Remember 5.18 activities so that we never forget the improper sampling inspection of fuel efficiency and exhaust gas in 2016 as well as the improper conduct regarding final vehicle inspection in 2018, are conducted in a way that all employees and officers, including the President, can take part, and we strive to foster a workplace culture where improper conduct does not occur due to compliance awareness and enhanced communication. Since FY2023, Suzuki has conducted Company-wide “stocktaking” activities as a general inspection, focusing on the relationship between operations and laws and regulations. These activities involve reviewing daily operations to identify and resolve issues while they are still minor.

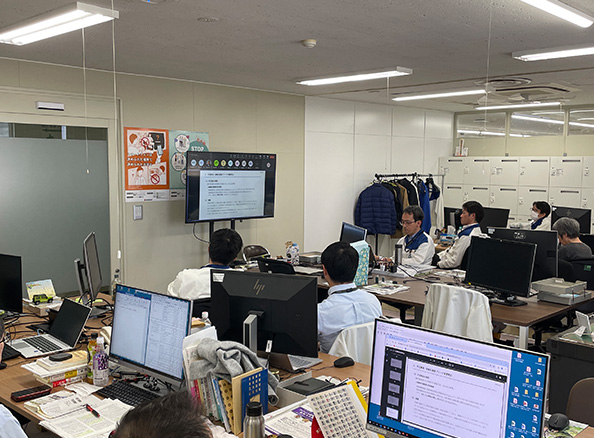

The Remember 5.18 activities in session (held on May 17, 2024)

In FY2024, these activities were expanded to 55 distributors in Japan and 5 major sites overseas. This fiscal year’s “stocktaking” activities primarily focused on issues with tasks affected by legal and other changes and newly added responsibilities, which were shared Company-wide, emphasizing personal accountability and reaffirming that Team Suzuki will work together to address them. Numerous tasks have improved since last fiscal year, and these activities are beginning to yield results. Efforts to improve daily operations will continue. Next fiscal year, we will expand these activities to overseas sites that have not yet been covered, further strengthening the Suzuki Group’s overall framework for engaging in compliance efforts.

We continued to hold worksite discussions. The President personally visits all divisions, plants, and sites of Suzuki Motor Corporation and exchanges views with employees on legal compliance and new operational measures. In FY2023, the President visited offices and sites in 39 Suzuki Motor Corporation locations throughout Japan.

JapanDomestic sales distributors

Sales distributors train employees through an education system suiting their type of work or career to develop staff that customers can rely on. In addition, they set up opportunities and attend lectures on harassment and the SDGs to create organizations where human capital can thrive and to manage risks.

Harassment training for managers

Suzuki Motor Sales Saga Inc.

PhilippinesSuzuki Philippines Inc.

Suzuki Philippines Inc. adopted its own Anti-Competition and Anti-Trust Law Guidebook, approved on December 19, 2023. Furthermore, on December 21, 2023, it announced the memorandum to all employees for guidance and legal compliance. The printed handbooks were distributed on April 16, 2024.

Risk management

Risk management system

Suzuki has established the Corporate Governance Committee under the Board of Directors. The Committee has been established to examine matters to ensure compliance and risk management, as well as to promote the implementation of measures to address cross- organizational issues in cooperation with related departments.

The Company ensures that issues occurring or recognized in any department are deliberated on promptly by the Corporate Governance Committee or another committee, depending on their urgency and severity. The Company checks concerns regarding the impact and measures from each division every week at the Executive Committee to quickly grasp the impact on the business and make necessary management decisions on issues related to product quality, homologations, and final vehicle inspections, as well as newer issues such as climate change and decarbonization, and issues of shortages of semiconductors and other parts or raw materials. Particularly important issues are discussed and reported by the Board of Directors.

Response to quality issues

The Company is working to strengthen its system for prompt investigation of causes and swift implementation of countermeasures to avoid situations in which the prolonged response to quality issues causes significant inconvenience to customers and an increase in the cost of countermeasures. The Company constantly keeps track of the latest status of quality issues at weekly and monthly meetings such as the Executive Committee. Market actions such as recalls are decided after deliberation by the Quality Assurance Committee, which is composed of related officers, Executive General Managers, and General Managers, etc.

Establishing a tax policy

Suzuki established the Suzuki Group Tax Policy as the basic policy for thorough tax compliance and to conduct appropriate tax payments.

(Established in December 2022 and revised in September 2024)

Tax Policy of the Suzuki Group

The Suzuki Group (hereinafter, “we”) shall conduct business by placing utmost importance on our motto and mission of developing products and providing services of superior value by focusing on the customer. Simultaneously, we understand the importance of being tax compliant, by duly fulfilling our obligations as a taxpayer and returning our profits to society through tax payments and strive to contribute to society.

(Legal Compliance)

We shall comply with the tax laws and tax treaties of individual countries and adhere to the spirit of international standards such as the OECD Transfer Pricing Guidelines and the BEPS Action Plan, thereby ensuring fair and equitable payment of taxes while also not engaging in unjust tax avoidance practices.

(Governance)

The executive officer in charge of finance oversees tax matters for the entire Suzuki Group. We have established appropriate reporting systems to deal with tax risks as part of an internal control mechanism, with the Board of Directors receiving reports on tax filings and other matters. Audit & Supervisory Board Members also attend those meetings and verify the content of the filings. Management strives to resolve tax risks that are crucial and/or require immediate attention through deliberations at meetings of the Board of Directors as necessary. Regular in-house training is conducted for every employee to deepen understanding and awareness of tax compliance.

(Relationship with Tax Authorities)

We shall take every possible opportunity to foster a trustworthy relationship with tax authorities. In addition, if there is a lack of mutual understanding with the tax authorities, we shall promptly communicate with them. Furthermore, we shall sincerely make transparent tax payments and deal with tax audits appropriately in accordance with the basic policy and guidelines.

(Prevention of Double Taxation)

We are well aware of the applicable double taxation risks arising because of international taxation, including transfer pricing. We follow the international transfer pricing guidelines as well as local regulations of the respective countries of operation when determining the prices of inter-company transactions. Furthermore, as a Group, we shall strive to eliminate the risk of double taxation by consultation with tax experts, negotiation with relevant tax authorities, and implementation of applicable remedies.

Efforts for preventing corruption

While acknowledging the existence of differences in laws and regulations related to competition such as anti-trust law, those related to fair trading, and societal norms in each country or region, the Suzuki Group will grasp the differences and provide training to employees to ensure that they observe laws and regulations and societal norms in their respective countries and regions. We will work to prevent all forms of corruption, including bribery.

● Efforts for preventing bribery

“Compliance” is included in the Suzuki Group Code of Conduct, and provisions regarding both “Bribery” and “Entertaining” are stipulated in the Compliance Handbook in an effort to prevent bribery.

To further clarify our approach to prohibiting bribery, in March 2024, following a resolution of the Board of Directors, we established the Suzuki Group’s basic policy regarding prohibition of bribery. Fully recognizing that bribery can lead to severe penalties and the loss of public trust in every country, we act in accordance with this basic policy to ensure we have no involvement in bribery or other unlawful practices.

We also require all business entities involved in our operations (including business partners, joint venture partners, consultants, agents, etc.) to comply with this basic policy.

Suzuki Group’s Principles on the Prohibition of Bribery

1. Purpose

The purpose of these Principles is to ensure that Suzuki Motor Corporation and its consolidated subsidiaries (hereinafter collectively referred to as “Suzuki Group”) and their officers and employees avoid involvement in any act of bribery and comply with the anti-bribery laws and regulations of all applicable countries, thereby fostering compliance with such anti-bribery laws and contributing to fair and ethical business practices.

2. Scope of Application

The scope of application of these Principles shall be Suzuki Group companies and their directors, officers, and employees.

3. Prohibition of Bribery

- i) The Suzuki Group shall not, directly or through intermediaries, offer, promise, or authorize any financial or other benefits to any public official or any officer or employee of other entity, whether domestically or internationally, for the purpose of obtaining or maintaining an improper advantage for the Suzuki Group, or to improperly influence the performance of his/her duties and responsibilities.

- ii) The Suzuki Group shall not, directly or through intermediaries, request or accept, or promise to accept, any financial or other benefits offered in connection with a transaction, whether domestically or internationally, for the purpose of improperly influencing the Suzuki Group’s business decision-making or the performance of its duties and responsibilities.

For the sake of clarity, in any of the cases mentioned in i) and ii) above, such entertainments, gifts, etc. that, based on circumstances such as timing, item, amount, frequency, and other relevant circumstances, are for ceremonial/festive purposes, or for other legitimate purposes, and do not exceed the scope of socially acceptable limits, shall not be deemed to contradict these Principles.

4. Prohibition of Facilitation Payments

The Suzuki Group shall not make any facilitation payments (i.e., minor payments to facilitate standard administrative processes) to public officials in any country or territory in connection with the Suzuki Group’s business activities.

5. Bribery by Business Partners, etc.

The Suzuki Group shall also require all business entities (including business partners, joint venture counterparties, consultants, agents, etc.) involved in its operations to comply with these Principles. If it is found that, or if there is good reason to believe that, another entity has engaged in bribery in connection with the business activities of the Suzuki Group, the Suzuki Group shall not engage in any transactions with such entity, and if the Suzuki Group is engaged in a transaction with such entity, the Suzuki Group shall terminate such transaction.

6. Records Management

The Suzuki Group shall prepare and maintain reasonably detailed, accurate and fair accounting records of all transactions and dispositions of assets (including, but not limited to, entertainments and gifts) in connection with the business activities of the Suzuki Group.

7. Prior Consultation

In the event of any doubts or uncertainties in relation to these Principles or in the event of noticing any wrongdoing, immediately report such doubts, uncertainties, or wrongdoing to your supervisor and consult the Legal Department (or a lawyer if the Legal Department is unavailable).

(Please see below for the definition of terms used in these Principles.)

Definitions

a) The term “public official” shall mean any of the following:

- i) Officials of the government, ministries and agencies, and local governments;

- ii) Officers and employees of government-affiliated companies and entities* (*i.e., companies and entities that are de facto controlled by the government, ministries and agencies, local governments, etc.);

- iii) Officers and employees of companies and entities engaged in specific activities related to the public interest;

- iv) Officials of international organizations;

- v) Politicians, and officers and employees of political party;

- vi) Officers and employees of the government, ministries and agencies, local governments, government-affiliated companies and entities, and business entities entrusted with administrative tasks by international organizations (e.g. testing institutions, etc.); or

- vii) Individuals equivalent to any the above-mentioned individuals (including candidates for such individuals).

b) The term “financial or other benefits” shall mean the following:

- i) Cash, coupons, gift certificates, gifts, stocks, loans, collateral, or guarantees;

- ii) Invitations to sports events, theatrical performances, trips, etc.;

- iii) Donations and sponsorship expenses;

- iv) Gratuities, rebates, promotional expenses, or discounts;

- v) Opportunities for employment, schooling, or similar advancement to an individual or their relatives; or

- vi) Benefits equivalent to any of the above.

● Compliance Handbook

Suzuki strives to prevent misconduct by specifying prohibited acts in its Compliance Handbook (e.g., making facilitation payments, providing entertainment for public officials who have an influence on corporate activities, etc.). Foreign language versions of the Handbook have been prepared and it is also being made available to Group companies.

● Internal regulations regarding entertainment

To build and maintain fair and proper relationships with all our business partners, Suzuki has prescribed internal regulations regarding entertainment received from our business partners and requires all executives and employees to obey these rules.

● Efforts for preventing anti-competitive behavior

Within the Suzuki Group Code of Conduct, Suzuki calls for compliance with laws and regulations, including competition laws, and provides thorough education in this area. Moreover, Suzuki is working to raise the level of understanding among employees by distributing a Compliance Handbook and Competition Law Handbook, which cite specific prohibited behavior in an easily comprehensible manner.

- Cartel and bid-rigging regulations (exchanging information with competitors, business alliances and OEMs, bid rigging)

- Regulations on unfair trade practices (unjust discriminatory treatment, resale price constraints, transaction term constraints, tie-in sales, abuse of superior bargaining position, misleading representations)

- Emergency response (prior consultation, cooperation with on-site inspections by government authorities)

Efforts for compliance with laws and regulations, respect for human rights and environmental conservation in the supply chain

In step with the global development of Suzuki’s business activities, its business partners and other stakeholders are increasingly multi-nationalized and diversified. As such, there are rising expectations for Suzuki to not only comply with the laws and social norms of each country but also fulfill its corporate social responsibilities (CSR) while giving consideration to the culture and history of each region.

Based on such social demands, Suzuki summarized in its CSR Guidelines for Suppliers its basic policy on the social responsibilities it must fulfill and the matters it must put into practice together with its business partners. Accordingly, Suzuki and its suppliers work as one team in promoting CSR activities.

Moreover, Suzuki newly established the Suzuki Group’s basic policy regarding human rights in December 2022. We believe that respect for human rights is the basis of all our corporate activities and are rigorous in this pursuit through each of the companies in the Suzuki Group. Furthermore, we expect all business partners associated with our business, including suppliers and dealers, to understand this policy and respect human rights, and proactively encourage and cooperate with them on their efforts.

Please refer to here for details on the Suzuki Group’s basic policy regarding human rights.

Business Continuity Plan (BCP)

The Company has formulated a BCP assuming the occurrence of Nankai Trough megathrust earthquakes, and based on this, secures the necessary cash on hand and lines of credit as one aspect of measures to prepare for natural disasters.

Disaster measures by Suzuki

Suzuki takes various measures for natural disasters including Nankai Trough megathrust earthquakes to give top priority to protecting employees’ lives and quickly resuming our business for our customers as well as minimizing the impact of damages. For example, we have taken various preventive measures such as earthquake resistance measures for buildings and facilities, fire prevention measures, establishment of the disaster action manual and Business Continuity Plan (BCP) that includes establishment of a disaster countermeasure organization, and purchase of earthquake insurance.

● Damage prevention

While the Group has been taking various measures to prevent anticipated damage caused by Nankai Trough megathrust earthquakes, after experiencing the Great East Japan Earthquake, it has diversified production and research sites including those overseas. Firstly, it relocated plants and facilities to the Miyakoda district in the northern part of Hamamatsu from the Ryuyo region in Iwata, Shizuoka, since massive tsunami damages are anticipated in the region. The Group has diversified its production of engines for mini-vehicles, which was concentrated at Sagara Plant, to Kosai Plant to mitigate risk. Furthermore, the Group is expanding its research facilities in India in order to mitigate risk concerning product development facilities for automobiles at Sagara Proving Grounds. In order to enhance the performance of disaster countermeasure headquarters, which is to be established following a disaster, the head office periodically conducts training with officers and each representative of the disaster countermeasure headquarters attending in cooperation with a consulting company specialized in disaster countermeasures. Through these initiatives, the Group will continue to enhance its preparedness against natural disasters.

● Efforts against earthquakes and tsunami taken by Suzuki for local residents

A part of Suzuki’s facilities is registered as a tsunami shelter for local residents, who are invited to see the shelter once a year. Also, we have a system in place to deploy watchmen to the roof of the head office when an earthquake occurs. There, manual and electric sirens are installed, and if a tsunami has been observed, a siren is sounded to notify staff and nearby residents. The electric siren is designed to be operated via a dedicated electric generator in case of a power failure.

Inspection tour of a tsunami evacuation area

● Measures against earthquakes and tsunami taken by Suzuki for employees

Earthquake Early Warning systems are installed at the head office, each plant, and manufacturing Group companies in an aim to protect the lives of our employees. Earthquake and tsunami evacuation drills are repeatedly conducted with participation from all employees so that when the Earthquake Early Warning system is activated, the employees are able to guarantee their safety, and at offices with risk of tsunami, safely evacuate to places where damage from flooding is not anticipated. We have established a system to confirm the safety of employees immediately when a disaster occurs via communication equipment such as satellite telephones and radios, which are installed at each plant and sales distributors all over Japan as an emergency communication tool, and we conduct a communication drill every month to be ready for an emergency.

Furthermore, as a method of confirming the safety of offduty employees, we introduced the “safety information system” in case an earthquake or tsunami occurs. When an earthquake with a seismic intensity of five lower or above occurs, in order to confirm the safety of employees and their families, this system automatically sends “safety inquiry e-mails” to e-mail addresses that each employee has registered and those who receive the e-mail send a reply about their own safety condition, allowing managers to confirm the situation. We conduct training twice a year so that we can confirm everyone’s safety immediately during a disaster.

Additionally, we distribute leaflets titled “What you should do at each home in advance to prepare for various disasters” to all employees so that each home can be ready for earthquakes and floods. We urge everyone to confirm individual contact information and evacuation sites as well as the risk to homes, etc. through hazard maps, and to stockpile supplies, and convey the importance of making preparations before disasters occur.

Earthquake and tsunami evacuation drills

A leaflet distributed in 2021

● Efforts against fire disasters

Suzuki works to identify the actual cause of even the smallest fires, to find out the real cause of the fire and thoroughly carry out effective measures, as well as conducts Companywide voluntary inspections in conjunction with fire prevention campaigns. We conduct fire drills using fire extinguishers and fire hydrants to minimize damage in the event of a fire, as well as drills in which fire trucks and small portable pumps are used to discharge water by the “private fire brigade,” a fire prevention organization consisting of employees.

Moreover, to ensure there are no fire prevention defects at plants and offices, we conduct fire disaster audits cross-checking each other in addition to fire prevention audits conducted in conjunction with insurance companies, setting fire disaster standards to prevent fires from breaking out and building a global fire disaster system including overseas plants.

Private fire brigade drill

Private fire brigade drill

Fire evacuation drill

Fire evacuation drill

● Contribution to construction of storm surge barrier in the coastal zone of Hamamatsu

Suzuki contributed a total of ¥500 million by the end of September 2014 to the “Hamamatsu Tsunami Protection Measure Fund” which Hamamatsu City has founded for constructing a tsunami barrier as a countermeasure for tsunami caused by earthquakes. In addition, a total of ¥500 million was donated to “Hamamatsu Sports Facility Construction Fund” by the end of March 2015 to cooperate with construction of a sports facility which serves as both a tsunami evacuation base and urgent relief heliport in case of a disaster. As a result, with the “Hamamatsu Tsunami Protection Measure Fund” and “Hamamatsu Sports Facility Construction Fund” combined, the total amount of contributions to the Hamamatsu City storm surge barrier was ¥1 billion.

The Company also contributed ¥340 million in total to eight neighboring cities and towns in western Shizuoka Prefecture, where many of its plants, associated facilities and business partners are located, for disaster measures such as earthquakes and tsunami by the end of March 2019, contributed ¥2.8 billion to Iwata City in August 2020 to promote the construction of the storm surge barrier, and donated a portion of land for the Ryuyo Proving Grounds in December 2021.

TOPICSGlobal Risk Management initiatives started

Suzuki started the Global Risk Management (GRM) initiative in FY2022 in cooperation with Tokio Marine & Nichido Fire Insurance Co., Ltd. and Tokio Marine dR Co., Ltd., which have risk management expertise, with the aim of building a system where “fire accidents don’t break out, are difficult to break out or quickly recover if they do break out.”

- (1) Formulate globally unified fire standards (P)

- (2) Conduct joint fire prevention audits (D)

- (3) Calculate a unified fire prevention score (C)

- (4) Activities to improve on findings (A)

Depending on the GRM initiative, we will enact a PDCA cycle, strengthening the planning and checking for the aforementioned three items while striving to enhance the effectiveness of the Do and Action we carry out daily.

In FY2022, we started initiatives in the Suzuki Motor Corporation’s main domestic plants and for domestic manufacturing subsidiaries, and plan to sequentially broaden their reach to development department facilities, sales offices and overseas offices.

Japan

Japan